Artificial Intelligence for Impact: The Future of Augmented Impact VC

For venture capitalists investing in impact, the role of data analytics and AI has the potential to be transformationally disruptive. Can we create impact alpha by integrating AI into core VC operations, now?

Years in the making

AI has topped the tech agenda for over a decade and is currently making its mark in the impact VC sector.

Katapult’s foundation and mission have been centered around addressing some of the world’s most pressing challenges. A primary way we achieve this is by directing capital towards impactful startups and exceptional founders. To date, our efforts have culminated in a series of funds, investments in over 160 impact tech startups, and the emergence of a couple of impact unicorns.

Every company within the Katapult portfolio has benefited from our comprehensive accelerator programs. Collectively, these initiatives have produced a wealth of actionable data. Since 2020, we’ve been exploring how to adopt a more data-centric and AI-driven approach. This curiosity sparked a sequence of R&D projects. Concurrently, over the past three years, we’ve incorporated new, transformative tools into the Katapult toolbox. named NorthStar – Impact Analytics, this toolkit is now accessible to select external users.

Why AI for impact?

In essence, impact investing in venture capital is focused on finding, predicting and funding impact founders who are scalable. Where we believe AI can play a pivotal role.

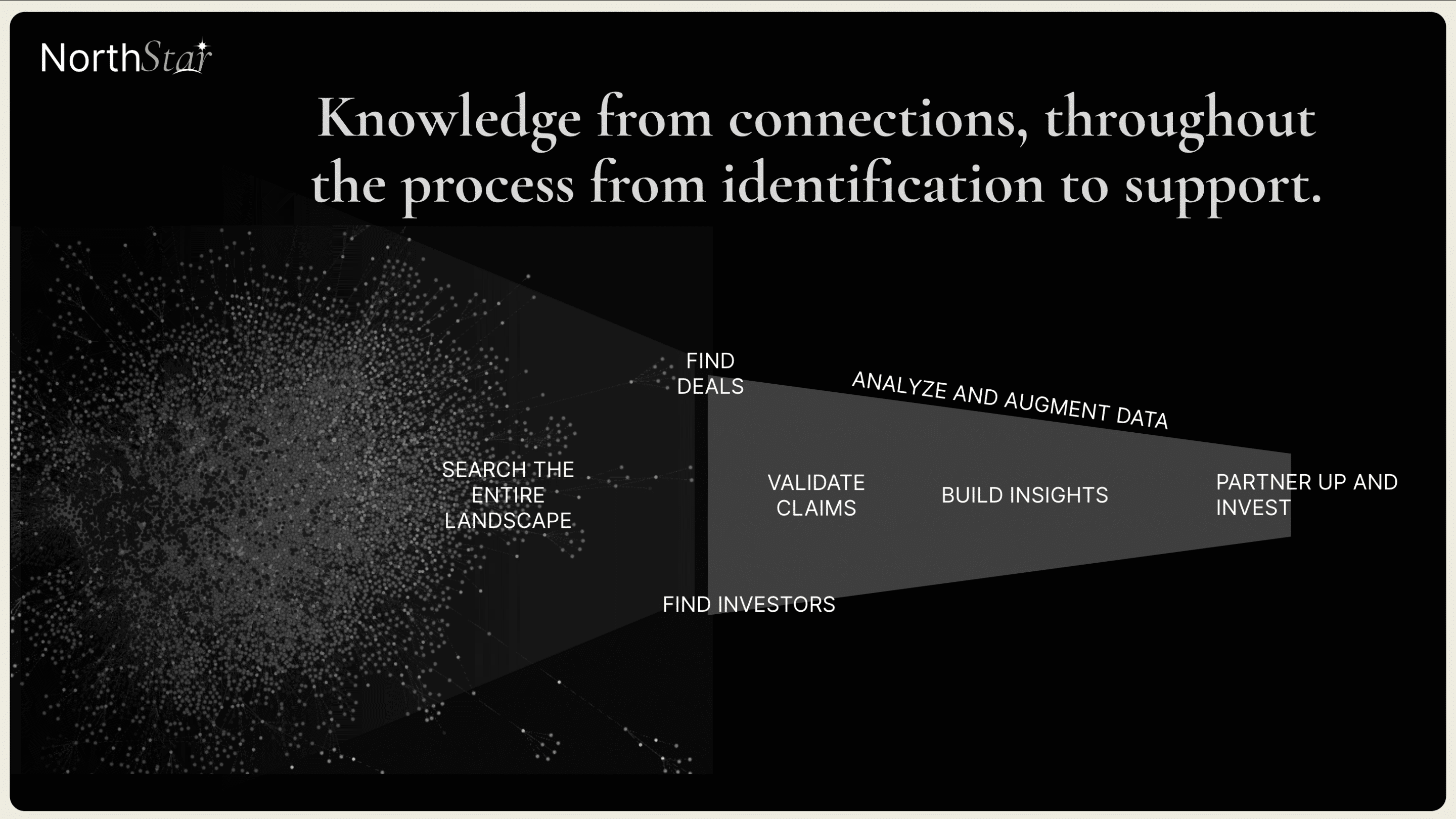

Handling a growing volume of early-stage investments means sifting through an even larger pool of companies. For us, the investment ratio has been one for every 100 companies screened. With more data becoming available on private and early-stage companies, we can consider a broader array of variables. This is beneficial not just for our portfolio companies and funds but also for an expanding network of LPs and co-investors. Through network graph analysis, we enhance every aspect of these operations.

Traditionally, the processes of scouting, screening, investing, and providing post-investment support have been manual, resource-intensive, and time-consuming. Additionally, impact reporting has often been chaotic, characterized by vast amounts of unstructured data, diverse methodologies, multiple frameworks, and moated expertise.

Now, we’re better equipped to tackle questions such as: How do you measure social impact? What makes an impact team effective? How can we gauge intentionality? Which impact metrics should a company should focus on and report on? What does the competitive landscape look like, including the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM)? And how does impact link to profitability?

Our experience in developing tools has shown that many of the operational challenges investors face are well-suited and ripe for an element of automation, streamlining processes significantly.

A 4 year trajectory

In 2020, Katapult Group embarked on a significant journey into data analytics and the application of machine learning and algorithms to harness the growing volume of data available both externally and internally. This exploration began with initial research funded by the Oslo Regional Research Fund (RFF Oslo) and expanded later in the year as we collaborated with Omdena, Seedstars, and Acrobator Ventures. Together, we launched a series of challenges that tapped into the machine learning community to investigate the use of ML in predicting optimal impact investing strategies

By early 2021, the outcomes of the Omdena challenge laid the groundwork for enhancing our data science capabilities. Katapult, in partnership with Seedstars and Bakken & Baeck, was awarded a Horizon 2020 research grant to advance these efforts and develop an AI system aimed at predicting startup success.

That same year, Katapult, The Factory, and Bakken & Baeck received a grant focused on creating an AI system to Identify, Assess, Quantify and Predict potential impact from startups. This initiative gave rise to Impactulator, a project that is slated for ongoing development through the end of 2024.

These projects have enabled Katapult to establish an internal AI and Data Analytics team dedicated to not only facilitating the delivery of these research initiatives but also to gearing up, anticipating, and steering the AI revolution within the venture capital sector.

Since 2021, we have directed and participated in a diverse array of R&D projects and developments, all aimed at enhancing the efficiency and analytical depth of our operations.

To further amplify our impact and test these innovations, we are now extending the reach of these tools to select external partners through the NorthStar carve out.

The achilles heel of impact investing

Reporting on impact alpha and effects, alongside profits, has consistently been a significant challenge in the field of impact investing. The emergence of a global impact investment community has spurred the development of more standardized tools and methods, recently accelerated by the rise of climate investing and regulatory frameworks like the EU taxonomy. This field of expertise has expanded rapidly as more investors strive to meet these regulations, representing an ideal application for machine learning and AI due to its complexity and the vast amounts of both structured and unstructured data involved.

We anticipate that the widespread challenge of documentation and reporting will be transformed by the introduction of new analytical tools. The expansion of R&D projects and partnerships, along with the creation of tools for impact assessment and reporting, will likely fast-track impact investing’s integration into traditional and mainstream investing sectors.

In the end, investments that don’t just reduce harm within existing industries, but replace them, document and report on real problem solving, are ideally what all investors should aim for. As such, the growth of better tools for reporting is both welcome, a necessity, and an impact alpha driver.

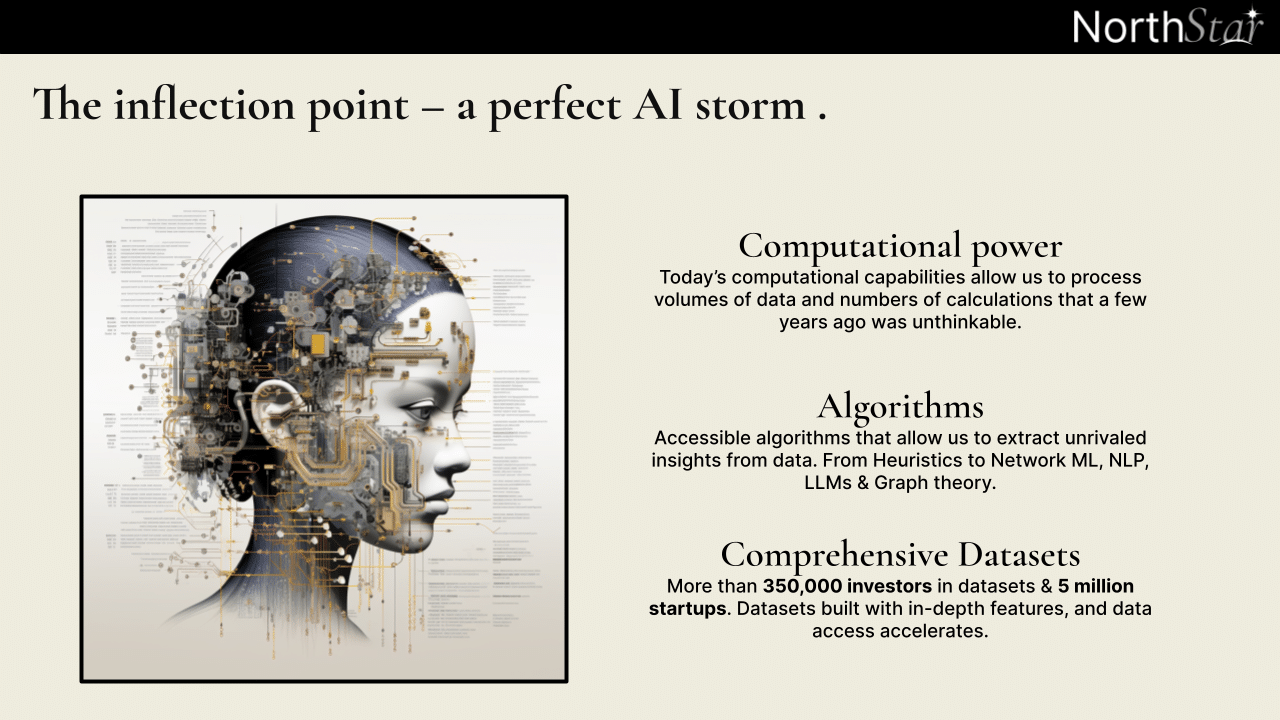

A historical inflection point – more than GPTs.

Katapult’s engagement in AI research and applications, as well as the broader development of AI tools, has been a long-term endeavor. Although GPTs and Large Language Models truly entered the public consciousness last year, the groundwork for today’s AI opportunities has been laid over many years.

AI has certainly been high on the tech-agenda for a long time. The key difference now lies in its convergence with three major developments.

- Comprehensive data sets: Over the last three years we have seen a revolution in the availability of data with providers like Pitchbook, Dealroom, Crunchbase, Tracxn, and many more. Together with large amounts of alternative data sets this has made it possible to make live analysis of new trends, deals and dealflows, and the investor landscapes and behavior.

- Computational power: Moore’s law continues to be true and the availability and resources needed to accompany the analysis of large amounts of data becomes cheaper and more accessible every month.

- Algorithms and models: Accessible models and training of algorithms on both open and proprietary data allows us to extract unrivaled insights from data we could only dream up some years ago. From Heuristics to Network machine learning to Graph theory to NLP and transformers (LLMs).

Together these developments –strengthened by everyones in-pocket GPT experiences– the applicability and availability is speeding up.

Pick the impact winner of the global haystack

Our initial goal for productivity was to reduce the time spent searching and increase the time devoted to creating value. By quickly identifying the right matches in the global landscape of startups and investors, and complementing this with faster, more precise analysis, we can streamline operations, run leaner if you may. This efficiency allows us to focus more on the core of impact investing: building relationships with the right founders and investors.

The value of people increases as AI tools are introduced.

The venture capital and impact investing sectors are fundamentally about people and relationships, in particular, investing for the long term

AI tools can help with the initial stages of investment sourcing, it can also assist with reducing the funnel size of investment opportunity, potential to support quantitative elements in impact reporting, freeing up time and enable investors to focus on aspects of the investment process that is relationship and qualitatively driven.

The NorthStar – a continuation of the journey

We know that investing in impact isn’t just a niche, to this end, we are launching NorthStar – Impact Analytics to better be able to support other VCs investing for impact and climate. Our goal is to utilize AI tools to assist impact VCs in their operations, and significantly increase the capital directed towards addressing the world’s critical environmental and social challenges.

To comply with the overall mission of channeling capital to the problem-solving impact founders and projects, we want other VCs to join us on this journey Our objective is to amplify the reach and effectiveness of impact investing while leveraging our AI development to remain at the forefront of AI-driven impact investing.

We want to share tools for scouting impact startups, get these into your investment pipeline, build efficient investment memos, and support you to connect your fund and portfolio companies with the most relevant LPs and VCs globally.

What’s next?

The application of AI and new tools is inevitable for impact investors, and the methods for their application are still evolving. At Katapult, we want to share what we have started with other impact driven investors, join us on this journey and continue to make these tools even better. . If you’re looking to speed up the process of assessing impact, scouting deals, and identifying LPs for your funds or finding VCs for your portfolio, we would be delighted to connect with you.

Feel free to contact us for a talk on partnering up, and if you want to learn more. Visit NorthStar IA’s website

This topic will further be high on the agenda at this year’s Katapult Future Fest investor day and we would love to see you there: